AdelFi is a financial institution that aligns with you, your family, your business, and your organization’s Christian values.

Savings

Competitive interest dividend rates that allow you to earn more while supporting Christian causes.

Lending

Loans that support your needs and help to expand the Kingdom.

Giving

Supporting financial stewardship, while giving back 10% to Christian-value aligned organizations.

Ask Better of Your Bank

At AdelFi, we believe in stewarding God’s resources, and making our products and services available to Christians across the nation. Does your banking serve a higher purpose? By switching to a Christ-centered financial institution, it can. Learn more about the AdelFi difference.

Learn MoreFeatured Products

Our Mission:

Partner with individuals, families, Christ-centered ministries, and businesses to protect, grow, and share their financial resources.

Learn More About Our Members' ImpactOnline & Mobile Banking at Your Fingertips, Literally

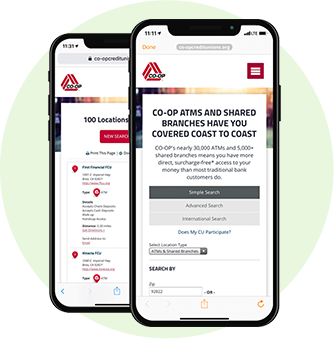

Branch & ATM Locations

CO-OP Shared Branch is a service that allows AdelFi members to participate in a national network of credit union branches. No matter where you live, work or travel, you'll always have access to your AdelFi and a local branch office.

- Withdraw fee-free cash near home or on the road

- Bank at 5,600 shared branches

- Use a network of 30,000 ATMs

AdelFi Kingdom Impact

We aim to be good stewards of our members and God’s resources by supporting Christian ministries, non-profits, and organizations throughout the U.S. and globally. For us, this means working with partners who contribute to Christian organizations that support family values, education, church planting, spreading the Gospel, and providing food, water, and shelter to those in need.

For 60 years, we have collaborated with those of shared faith to create positive change and be the salt and light of the Earth. Since we started our Give Back program in 2022, we've given over $4 million, and in 2023, we volunteered 750 staff hours to non-profits, ministries, and missionaries committed to serving the Lord and spreading His word.

Where AdelFi Gives and Invest its Money

Unlike traditional big banks, which may invest their customers' money in causes that may not be aligned with Christian values or financial institutions that are beholden to Wall Street investors, AdelFi is owned and controlled by its members who share the same faith. Supporting individuals, families, ministries, businesses, and those wanting their banks to be aligned with their same values is what separates AdelFi from others in the industry.

Christian Family Values

Christian Education

Spreading the Gospel

Food, Water, and Shelter

Church Planting and Assistance

What Our Members Say

Your customer service has been outstanding to date. Whenever I talk to an AdelFi representative over the phone, there is a "can-do" attitude. Not to mention, I am glad to know that the Lord's resources are being used to further His Kingdom. It means a lot to me.

- John D.

Member since 1993

Just wanted to thank you for your Start Young accounts. Between breaking up wrestling matches among our three boys, we try to impart some character-building skills, and your kids accounts are helping them become more responsible with their money. We appreciate that your team is watching out for us and our boys.

– Andrea & Doug B.

Members since 2002

In this season of our lives, we like to be good stewards with our money and handle it according to God’s values. It just makes sense to entrust our money to a strong and growing institution like AdelFi that supports the same biblical ideals we believe in.

– Anna and Adam D.

Members since 2007

1APY (Annual Percentage Yield); 2Annual Percentage Rates (APR) ✝13-Month Certificate, New Money ONLY